- Homepage/

- Allica Bank

Details for Allica Bank neobank

A specialised UK-based digital bank for SMEs offering business loans, savings accounts and business accounts.

TrustPilot Score:

4.5

Total customers:

50,000

Allica Bank is available in:

What is Allica Bank?

Allica Bank is a prominent UK challenger FinTech that offers specialised business banking services to SMEs. It was launched in 2020 and is headquartered in London, UK.

Allica Bank offers a broad selection of business financial products and banking services, such as business loans, savings accounts and business current accounts. This neobank's loans are aimed at supporting the growth and expansion of SMEs and often have flexible repayment terms and very competitive interest rates. This neobank is known for its attractive savings accounts, which offer competitive interest rates and have no hidden fees or charges.

Which services does Allica Bank offer?

Allica Bank offers a broad range of financial services, including:

- free or low-fee bank accounts,

- free physical and virtual bank cards (included in the plan),

- current accounts with a unique IBAN number,

- flexible in-app customisation,

- business loans, including term loans, asset finance, and revolving credit facilities,

- savings accounts for businesses and personal savings accounts, including instant access accounts, notice accounts, and fixed-term accounts,

- business current accounts with in-built features, such as online banking, mobile banking, and debit cards,

- cash management services, including tools and resources for managing invoices, payments, and receipts,

- business credit cards with flexible credit limits and rewards programs designed to meet the needs of small and medium-sized businesses.

What Are Allica Bank's Main Advantages?

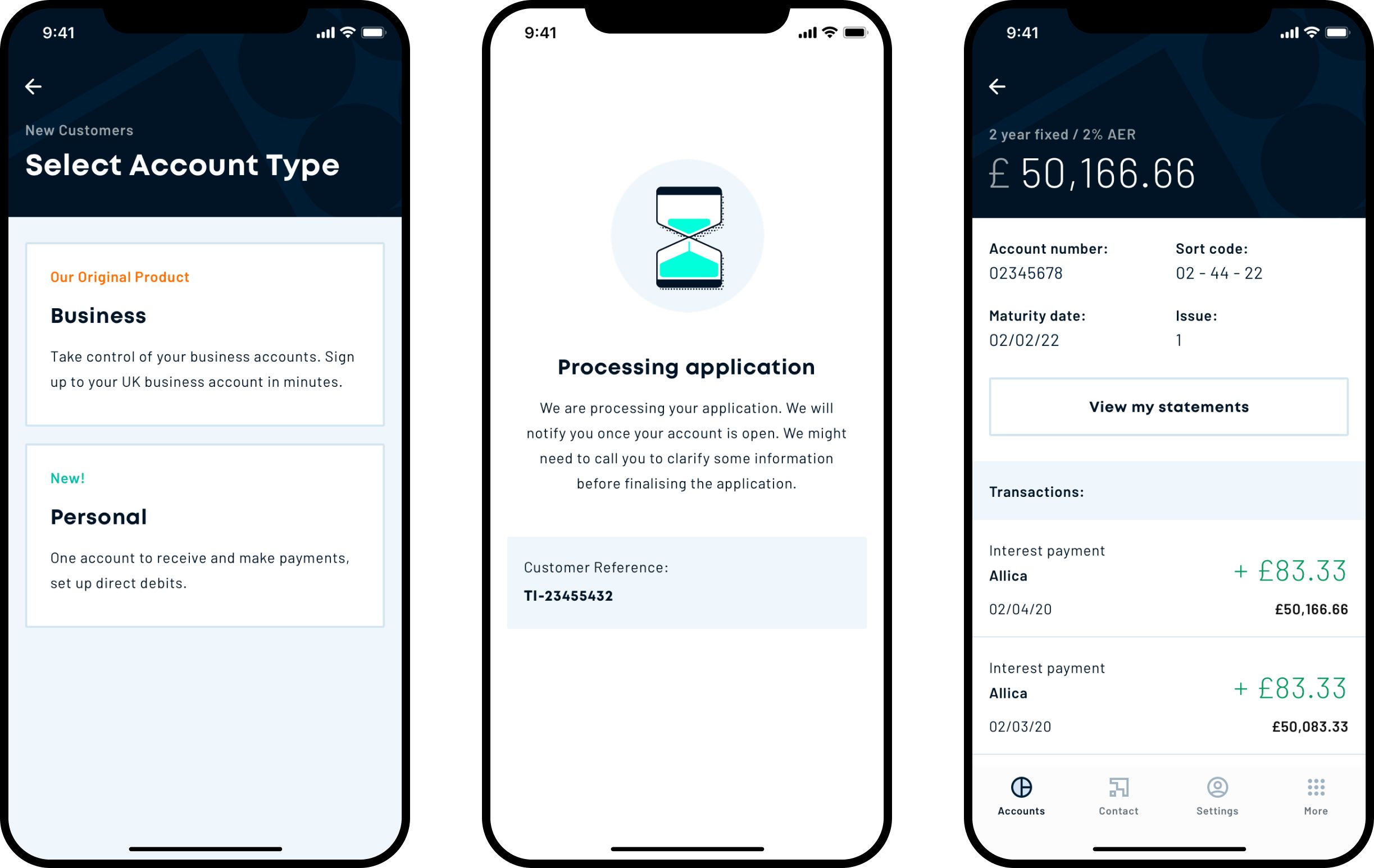

One of the core advantages of this neobank is its versatile mobile app (both Android and iPhone apps are supported).

Allica Bank app offers a high level of customisation and real-time notifications for transactions and spending insights, as well as budgeting tools for tracking spending and ultimately saving money. Allica Bank is focused on providing financial services primarily to SMEs in the United Kingdom. Its range of financial products and services is designed to help businesses manage their finances and grow operations.

Allica Bank has gained a large following in the United Kingdom, in particular among small business owners, entrepreneurs, SMEs and freelancers.

Currently, Allica Bank has over 50,000 customers in the UK. This neobank also has physical offices in Milton Keynes, Manchester and London, and a team of expert relationship managers out on the road across England, Scotland and Wales, providing personal support to SMEs in their local communities.

Who is Eligible to Open an Allica Bank Account?

Allica Bank currently opens bank accounts for UK legal residents and for UK-incorporated companies and businesses.